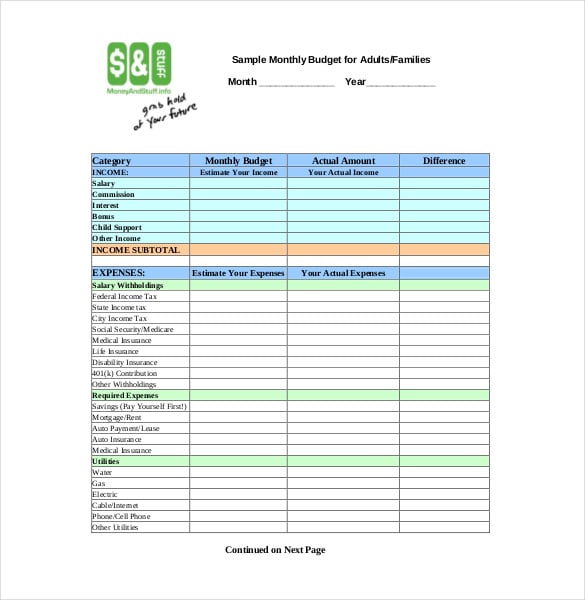

Make sure to list the items you regularly spend on, such as personal goods and household bills. This could either be annually or monthly reports, depending on your personal preference. Calculate your total income and expenses.

PERSONAL BUDGET EXAMPLE HOW TO

You may learn how to use Excel better in the process. To create a personal budget, take note of the following steps: Identify your income and expenses. If you use and customize any template for your personal budget, make sure you understand how it works and always double-check the formulas. Whether you want to better control your finances or are saving for a specific goal, there’s a personal budgeting template from Excel that will work for you. Monthly and yearly totals are calculated, and sparklines highlight trends and patterns in your spending. their own personal financial goals and budget. The flexibility comes at the price of possibly deleting or messing up an important formula, or making bad assumptions. Personal budget templates help you track monthly income and expenses. A personal budget is a financial plan that allocates future income toward expenses. In my opinion, the #1 problem associated with using a spreadsheet for your personal budget is the chance that you'll make errors. it's just a disclosure to say that I don't ONLY use Excel any more.Ī spreadsheet may not be the best budgeting solution for everybody.

PERSONAL BUDGET EXAMPLE DOWNLOAD

I started out using Excel to do everything, but I began using Quicken after a friend showed me how easy it was to keep track of checks and credit card charges and download transactions directly from my bank. A budget is almost useless without tracking what you are spending. For expense tracking, you could use my Income and Expense Worksheet, Checkbook Register, or the newer Money Manager.

Tracking your income and spending comes both before and after making a budget. For example, I like to use cell comments to explain certain budgeted items in more detail (such as the fact that in May, there is Mother's Day and a couple of birthdays to remember).Ĭreating a simple personal budget (even if it is only on paper) is one of the first steps to gaining control of your spending habits. The reason I use Excel when working with my home and business budgets is that it gives me complete flexibility to keep track of the information the way I want to.

If you don't own Excel, then Google Sheets and OpenOffice are free options to consider. Microsoft Excel isn't free, but if you already own Excel, then you can create a budget without purchasing other budgeting software. 42 Effective Ways to Save Money Budgeting Tips for the New Year Why Use Excel for your Personal Budget?įirst reason: it's free.

0 kommentar(er)

0 kommentar(er)